Well…, ni ada iseng-iseng rangkuman artikel lagi. Tau gak bro ngumpulin artikel ni benwitku ampe ngos-ngosan ixixix. Tau sendiri kan kalo aku ni fakir benwit, tapi buat bro-bro semua sih oke-oke aja tak cariin artikel yang rada-rada nyentrik, menghibur, beda dari yang lain dan bebas dikopi paste lah pokoknya silahkan disedot-sedot aja kalo mau monggo…

Well…, ni ada iseng-iseng rangkuman artikel lagi. Tau gak bro ngumpulin artikel ni benwitku ampe ngos-ngosan ixixix. Tau sendiri kan kalo aku ni fakir benwit, tapi buat bro-bro semua sih oke-oke aja tak cariin artikel yang rada-rada nyentrik, menghibur, beda dari yang lain dan bebas dikopi paste lah pokoknya silahkan disedot-sedot aja kalo mau monggo…

1. Wal-Mart Stores

Rank: 1 (Previous rank: 1)

Rank: 1 (Previous rank: 1)

CEO: H. Lee Scott Jr.

Employees: 2,055,000

Address: 702 S.W. Eighth St.

Bentonville, Arkansas 72716

Country: U.S.

Website: www.walmartstores.com

Retaining its spot as the largest company in the world, the retail giant spent the last year making strides toward becoming friendlier to its workers and the environment. Long derided for the limited health-care packages offered to its employees, the company focused on expanding its options. As of January, 93.7% of Wal-Mart’s U.S. employees had some form of health care, up from 90.4% last year.

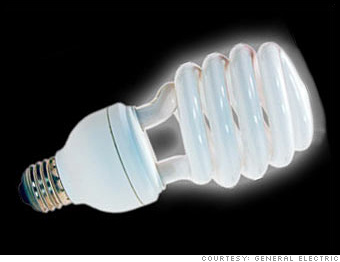

On the sustainability front, the retailer sold 145 million energy-efficient light bulbs in 15 months and joined forces with the Clinton Climate Initiative. Some say it isn’t enough; a union-backed ad campaign by WakeUpWalMart.com at the end of 2007 targeted the quality of the company’s imported products.

Still far from pleasing all its critics, Wal-Mart did please its shoppers: Its renewed focus on lower prices delivered a stellar second half, bolstering total revenue for the year to $379 billion.

2. Exxon Mobil

Rank: 2 (Previous rank: 2)

Rank: 2 (Previous rank: 2)CEO: Rex W. Tillerson

Employees: 107,100

Address: 5959 Las Colinas Blvd.

Irving, Texas 75039

Country: U.S.

Website: www.exxonmobil.com

Exxon had its best year ever in terms of safety results, while the competition didn’t fare as well. But the high cost of refining hurt Exxon just as much as it hurt the rest. Even with a record of $40.6 billion in net income, profits were up only 2.8% from the previous year.

CEO: Jeroen van der Veer

Employees: 104,000

Address: Carel van Bylandtlaan 30

The Hague 2596

Country: Netherlands

Website: www.shell.com

But the year wasn’t without glitches. Shell saw its stake in one of its biggest projects – the Russian-based Sakhalin II – reduced to 27% from 55%, as the Russian government asserted control over the country’s oil industry.

4. BP

Rank: 4 (Previous rank: 4)

Rank: 4 (Previous rank: 4)CEO: Anthony B. Hayward

Employees: 97,600

Address: 1 St. James Sq.

London SW1Y 4PD

Country: Britain

Website: www.bp.com

Much of the U.K.-based company’s time was spent handling its U.S. operations, as it modernized Whiting and dealt with the repercussions of the 2005 blast in Texas City. Yet the American operations weren’t all bad news – a $2.4 billion investment in the San Juan basin and deepwater drilling projects in the Gulf could be helpful in the next few years, once BP’s messes are behind it.

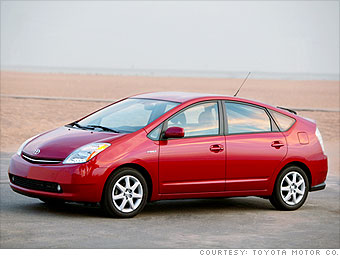

5. Toyota Motor

Rank: 5 (Previous rank: 6)

Rank: 5 (Previous rank: 6)CEO: Fujio Cho

Employees: 316,121

Address: 1 Toyota-cho

Toyota 471-8571

Country: Japan

Website: www.toyota.co.jp

But the Japanese company gained on its rival in the United States: GM’s sales fell 6% on its home turf, while Toyota’s sales rose 3.1%.

Rank: 6 (Previous rank: 7)

Rank: 6 (Previous rank: 7)CEO: David J. O’Reilly

Employees: 65,035

Address: 6001 Bollinger Canyon Rd.

San Ramon, California 94583

Country: U.S.

Website: www.chevron.com

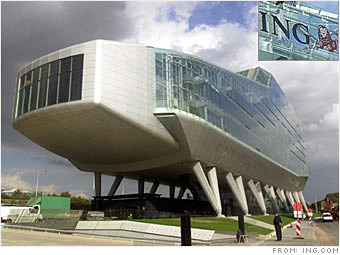

Employees: 120,282

Address: Amstelveenseweg 500

Amsterdam 1081

Country: Netherlands

Website: www.ing.com

ING continued to push into emerging markets, with primary investments in Thailand, Latin America, Turkey and South Korea. Although INGDirect.com provides just a small portion of the company’s profits, it added 3 million users in 2007, and now boasts over 20 million users worldwide.

Employees: 96,442

Address: 2 Pl. de la Coupole

Courbevoie 92400

Country: France

Website: www.total.com

Employees: 266,000

Address: 300 Renaissance Center

Detroit, Michigan 48265

Country: U.S.

Website: www.gm.com

Rank: 10 (Previous rank: 9)

Rank: 10 (Previous rank: 9)Employees: 32,600

Address: 600 N. Dairy Ashford Rd.

Houston, Texas 77079

Country: U.S.

Website: www.conocophillips.com

CEO: Dieter Zetsche

Employees: 272,382

Address: Mercedesstrasse 137

Stuttgart 70327

Country: Germany

Website: www.daimler.com

12. General Electric

Employees: 327,000

Address: 3135 Easton Turnpike

Fairfield, Connecticut 6828

Country: U.S.

Website: www.ge.com

Employees: 246,000

Address: 1 American Rd.

Dearborn, Michigan 48126

Country: U.S.

Website: www.ford.com

CEO: Jean-Paul Votron

Employees: 62,009

Address: Rue Royale 20

Brussels 1000

Country: Belgium/Netherlands

Website: www.fortis.com

CEO: Henri de Castries

Employees: 103,534

Address: 25 Ave. Matignon

Paris 75008

Country: France

Website: www.axa.com

CEO: Su Shulin

Employees: 634,011

Address: A6 Huixindong St.

Beijing 100029

Country: China

Website: www.sinopecgroup.com.cn

Employees: 380,500

Address: 399 Park Ave.

New York, New York 10043

Country: U.S.

Website: www.citigroup.com

CEO: Martin Winterkorn

Employees: 329,305

Address: Brieffach 1848-2

Wolfsburg 38436

Country: Germany

Website: www.volkswagen.de

CEO: Axel Miller

Employees: 35,202

Address: Place Rogier 11

Brussels 1210

Country: Belgium

Website: www.dexia.com

CEO: Michael F. Geoghegan

Employees: 322,282

Address: 8 Canada Sq.

London E14 5HQ

Country: Britain

Website: www.hsbc.com

CEO: Baudouin Prot

Employees: 162,700

Address: 16 Blvd. des Italiens

Paris 75009

Country: France

Website: www.bnpparibas.com

CEO: Michael Diekmann

Employees: 181,207

Address: Königinstrasse 28

Munich 80802

Country: Germany

Website: www.allianz.com

Employees: 163,126

Address: 91-93 Blvd. Pasteur

Paris 75015

Country: France

Website: www.credit-agricole-sa.fr

CEO: Liu Zhenya

Employees: 1,486,000

Address: 86 Xichang’an Ave.

Beijing 100031

Country: China

Website: www.sgcc.com.cn

CEO: Jiang Jiemin

Employees: 1,117,345

Address: 6 Liupukang St.

Beijing 100724

Country: China

Website: www.cnpc.com.cn

Sumber : fortune

0 komentar:

Posting Komentar

Yang mau cerita Sok cerita!!!